colorado springs sales tax rate

Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. On July 12 2021 the City of Colorado Springs Sales Tax Office will be transitioning to a new online licensing and tax filing system powered by MUNIRevs.

Sales Tax Information Colorado Springs

Denver co sales tax rate.

. You can print a 82 sales tax table here. The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales taxWhile Colorado law allows municipalities to collect a local option sales tax of up to 42 Colorado Springs does not currently collect a local sales tax. How 2021 Sales taxes are calculated for zip code 80909.

The combined rate used in this calculator 513 is the result of the colorado state rate 29 the 80921s county rate 123 and in some case special rate 1. A Colorado Springs resident owns a home in the C ity and a ranch in the mountains. 307 Sales and Use Tax Return.

The Colorado Springs Colorado general sales tax rate is 29. Did South Dakota v. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax.

This is the total of state county and city sales tax rates. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8There are a total of 223 local tax jurisdictions across the state collecting an average local tax of 3419. January 1 2016 through December 31 2020 will be subject to the previous tax rate of 312.

In addition to taxes car purchases in Colorado may be subject to other fees like. In November 2019 Colorado Springs voters approved a five-year extension of the 2C sales tax that generates revenue specifically for road improvements. Colorado has 560 special sales tax jurisdictions with local sales taxes in.

Companies doing business in Colorado need to register with the Colorado Department of Revenue. Find cars listings for sale starting at 3495 in colorado springs co. The 80909 Colorado Springs Colorado general sales tax rate is 82.

Groceries and prescription drugs are exempt from the Colorado sales tax. Sales tax rates generally change every six months on January 1st and July 1st. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

What is the sales tax rate in Colorado Springs Colorado. How 2021 sales taxes are. The colorado springs colorado sales tax rate of 82 applies to the following 35 zip codes.

The vehicle is principally operated and maintained in Colorado Springs. The extension is at a reduced tax rate of 057 down from 062. The current total local sales tax rate in Colorado Springs CO is 8200.

Visit the Sales Tax Rate Changes web page for information on the most recent sales tax rate changes. Property taxes are the main source of revenue for schools in Colorado. For tax rates in other cities see Colorado sales taxes by city and county.

Property Taxes Property taxes vary a lot based on where you live. This system will greatly improve our businesss experience by allowing businesses to file and pay taxes at any time via an internet connected device view their account history on demand and delegate access to tax. However because of numerous additional county and city sales taxes actual combined rates can be as high as 1120.

Every 2021 combined rates mentioned above are the results of Colorado state rate 29 the county rate 123 the Colorado Springs tax rate 0 to 312 and in some case special. Sales Taxes In the Colorado Springs area sales tax is 825. Visit the How to Look Up a Sales Tax Rate web page for information on how to look up a specific rate.

The Colorado sales tax rate is currently. The combined rate used in this calculator 82 is the result of the Colorado state rate 29 the 80909s county rate 123 the Colorado Springs tax rate 307 and in some case special rate 1. The Colorado CO state sales tax rate is currently 29.

The Colorado Springs sales tax rate is. When purchasing a new car the individual p roperly paid city sales tax to the dealer and. Depending on the zipcode the sales tax rate of Colorado Springs may vary from 29 to 825.

The minimum combined 2021 sales tax rate for Colorado Springs Colorado is. The 80911 Colorado Springs Colorado general sales tax rate is 513. Taxes for auto dealers get a little trickier because we collect taxes based on a couple of different factors.

The December 2020 total local sales tax rate was 8250. When considering these local taxes the average Colorado sales tax rate is 772. Depending on local municipalities the total tax rate can be as high as 112.

How 2021 Sales taxes are calculated for zip code 80911. Combined with the state sales tax the highest sales tax rate in Colorado is 112 in the city of. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax.

Instructions for City of Colorado Springs Sales andor Use Tax Return. The County sales tax rate is. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

307 Sales and Use Tax Return in Spanish. The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the country at just 290. The december 2020 total local sales tax rate was 8250.

GENERALLY we plan for property taxes to be roughly 075 of the market value of the home. The minimum combined 2021 sales tax rate for colorado springs colorado is. The maximum tax that can be owed is 525 dollars.

Click here for a larger sales tax map or here for a sales tax table. City sales tax collected within this date range will report at 312. City sales tax is due on the net purchase price of the vehicle.

Colorado springs co tax and accounting services firm expect tax accounting inc. Colorado collects a 29 state sales tax rate on the purchase of all vehicles. The combined rate used in this calculator 513 is the result of the Colorado state rate 29 the 80911s county rate 123 and in some case special rate 1.

31 rows With local taxes the total sales tax rate is between 2900 and.

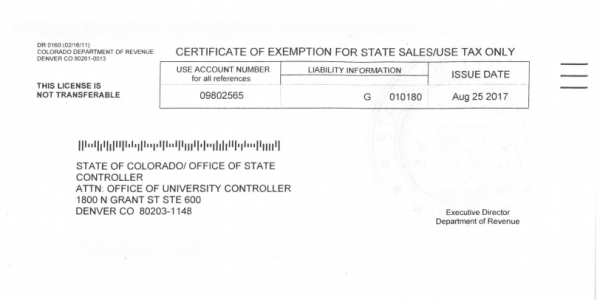

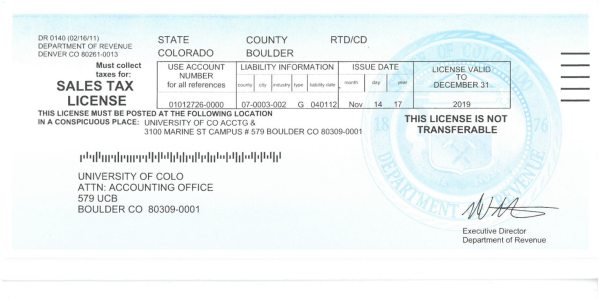

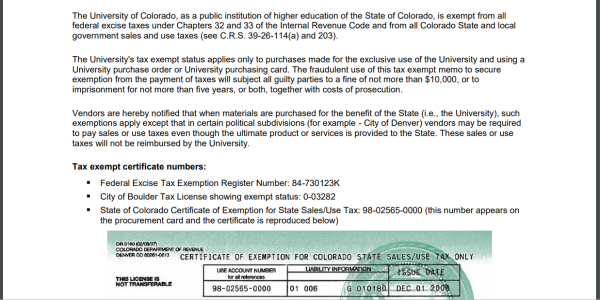

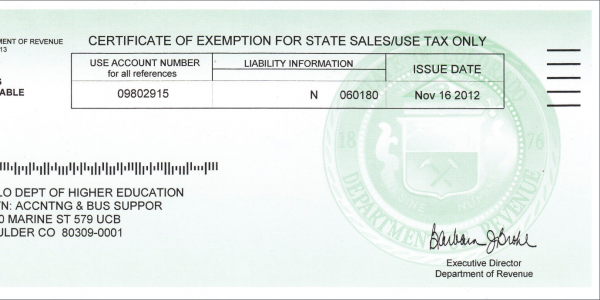

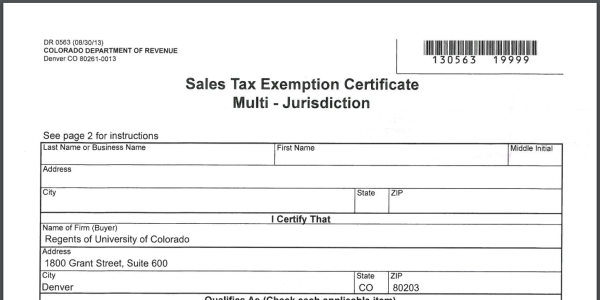

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Campus Controller S Office University Of Colorado Boulder

Colorado Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Information Colorado Springs

Sales Tax Campus Controller S Office University Of Colorado Boulder

Kansas Sales Tax Rates By City County 2022

The Mohave County Arizona Local Sales Tax Rate Is A Minimum Of 5 6